Revenue cycle management in healthcare is no longer about gathering metrics once a month and reacting. Today’s front‑line leaders demand real‑time insights, predictive alerts, and automation that helps them act before revenue slips through the cracks. With the global RCM market projected to grow sharply as providers embrace cloud‑based automation and AI, tracking performance metrics automatically is now part of financial resilience in 2026 as much as in 2025.

At the heart of this evolution is healthcare predictive analytics software, which uses historical data, machine learning, and pattern recognition to forecast financial risk, denial trends, and revenue bottlenecks. These tools help organizations focus staff time on decisions that genuinely require human judgment, freeing them from repetitive monitoring tasks.

Evolving Expectations for KPI Automation

Healthcare RCM has historically been burdened by manual workflows, siloed systems, and delayed reporting. The impact? Slower revenue cycles, preventable denials, and mounting administrative costs. According to market insights, over 70% of providers now adopt digital RCM automation to improve claim accuracy and financial visibility, with cloud‑native platforms and integrated analytics rising quickly.

Tracking RCM performance metrics in hospitals through automation enables teams to detect issues as they happen, rather than after the fact. Real‑time dashboards, trend alerts, and predictive signals replace the static spreadsheets that once left finance leaders chasing yesterday’s data.

How This Shift Helps Financial Teams

Automation isn’t just about speed. It helps teams:

- Catch coding and eligibility errors before submission

- Lower denial rates through proactive insights

- Free staff from repetitive reporting

- Highlight financial trends and outliers early

These outcomes drive measurable improvement in cycle efficiency, cash collection timelines, and net revenue.

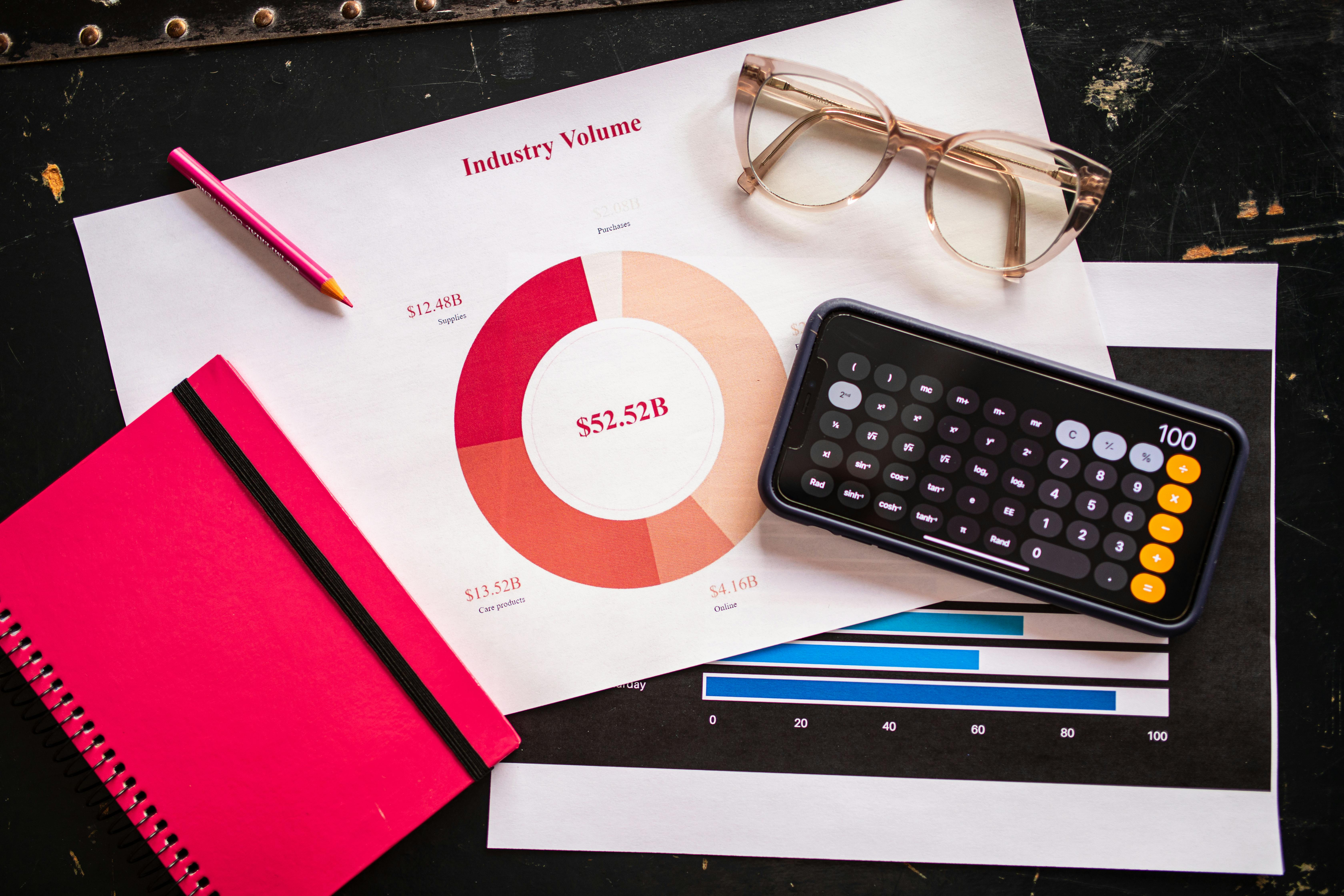

Key Metrics That Modern Systems Should Track

Below are high‑impact KPIs that deserve automated tracking because they shape financial outcomes and operational performance.

Clean Claim Rate

One of the earliest indicators of RCM health, clean claim rate measures claims accepted on the first submission. Automating monitoring here reveals recurring issues in documentation or coding and reduces costly rework cycles.

Denial Metrics and Patterns

Rather than solely tracking denial counts, today’s systems analyze why denials occur, visualizing root causes and payer‑specific trends through advanced modeling. This enables teams to prevent denials instead of scrambling to fix them.

Days in Accounts Receivable (AR)

Days in AR reflects how quickly a provider gets paid. Automated alerts for rising AR help teams intervene quickly, improving cash flow and shrinking revenue lag.

Net Collection Rate

Net collection rate shows how much expected revenue was actually collected. Automation enriches this KPI with predictive forecasts, helping leaders anticipate dips before they erode monthly performance.

The Power of Healthcare Analytics and AI in KPI Tracking

The real leap in KPI automation comes through AI in healthcare revenue cycle processes. AI models built into RCM platforms don’t just execute tasks faster. They reason over data and find trends humans might miss:

- AI‑driven platforms can score claims for denial risk and recommend edits before submission

- Natural language models help improve documentation quality by aligning clinical notes with accurate billing codes

- Predictive ranking guides revenue team priorities by likelihood of payment delay

- Interfaces merge workflows across eligibility checks, claims, and appeal processes

This intelligent automation, powered by advanced healthcare analytics, turns large financial data volumes into prioritized action plans.

Beyond Reporting to Prediction

Predictive analytics in healthcare goes beyond historical reporting. Instead of simply describing what happened, these models forecast what is likely to occur based on patterns in claim submissions, payer responses, and patient behavior.

For example, predictive models can:

- Identify claims likely to be denied so teams can correct them first

- Forecast revenue shortfalls weeks before they appear in cash reports

- Signal how changes in payer rules may affect reimbursement timing

Organizations that adopt predictive models in RCM are seeing measurable improvements in claims accuracy and significant reductions in denials. Leveraging real-time insights is increasingly critical, which is why understanding why healthcare needs real-time data more than ever is essential for modern revenue cycle strategies.

Choosing the Right Analytics Tools

Getting KPI insights requires more than dashboards. It demands healthcare analytics solutions that unify data across billing, clinical systems, and payer feeds, giving teams the complete picture they need. This often leads organizations to invest in healthcare analytics consulting to refine data models, harmonize sources, and align metrics with strategic goals.

With integrated systems, finance leaders can spot trends, benchmark performance, and use healthcare big data analytics to guide both operational and strategic decisions. And as regulations evolve, tools that provide audit trails and compliance insights become even more valuable.

Critical KPI Anchors for Financial Health

Here are performance indicators that advanced RCM automation should measure:

- Clean claim rate

- Denial rate and root cause insights

- Days in AR

- Net collection rate

- Cash forecast accuracy

- First‑pass resolution rate

Each of these indicators becomes more powerful when measured continuously rather than as a monthly snapshot.

Frequently Asked Questions

What are the most impactful KPIs for revenue cycle performance?

Automated KPI tracking should begin with metrics that directly affect revenue velocity and accuracy, like clean claim rates, denial patterns, and days in AR. Combining these gives a real‑time picture of financial health.

How can AI improve KPI tracking in RCM?

AI enhances KPI tracking by proactively identifying patterns, scoring risk, and recommending corrective actions before issues affect reimbursement. This accelerates cash flow and strengthens revenue integrity.

Is predictive analytics useful for small practices?

Yes. Even smaller providers benefit from predictive insights, especially when manual processes limit visibility. Cloud‑based analytics tools can scale KPI automation without heavy infrastructure investment.

Can automation reduce revenue leakage?

Absolutely. Automated tracking identifies inefficiencies that lead to revenue leakage, such as recurring denials or slow payment workflows, and highlights corrective actions for finance teams.

What role does consulting play in analytics adoption?

Healthcare analytics consulting helps organizations define meaningful KPIs, align them with strategy, and integrate systems for accurate and unified reporting.

What Next for Your RCM Strategy?

If your organization is not yet automating revenue cycle tracking, the time to act is now. As healthcare predictive analytics software continues to advance in 2026, your ability to capture real‑time insights and anticipate financial challenges will define competitive performance.

Are you ready to elevate your revenue cycle with smarter, predictive automation? Schedule a call with Ascend Analytics today to unlock KPI insights that drive measurable results and strengthen your bottom line.